watch now

More articles about: stocks

With stable revenue visibility, strong liquidity, and reliable cash flows, SPC has long been considered one of the more defensive names in the power generation space. Yet in a market dominated by fear rather than analysis, even fundamentally sound firms can experience sharp mispricings.

The Philippine stock market continues to struggle under the weight of persistent uncertainty. Last week, the Philippine Stock Exchange Index (PSEi) attempted a brief stabilization, but the rebound was short-lived.By the end of the week, the index had slipped to ...

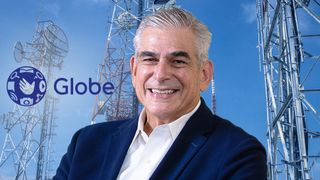

From a high of around P2,400 per share in early 2024, the stock has fallen to roughly P1,450 by November 2025, which represents a decline of about 40 percent. Does Globe’s current weakness reflect a structural decline or a mispricing of a business whose fundamentals remain intact?

The Philippine stock market has endured one of its most difficult stretches in years. As of Monday (November 10), the Philippine Stock Exchange Index (PSEi) trades near 5,700, down more than 1,000 points year-to-date, weighed by persistent foreign ...

Maynilad's IPO, the biggest listing in he country in four years, comes amid reports of the PSE index being the "world's worst-performing stock index,"

Local water concessionaire Maynila Water Services (PSE:MYNLD) has officially made its debut as a publicly listed company in the Philippine Stock Exchange. It's a crucial listing as the PSE index struggles to improve its reported status as the world's ...

Despite the prevailing market sentiments, FGEN has quietly carried out one of the most ambitious clean-energy transitions in the region.

When investors think about volatility in the Philippine Stock Exchange (PSE), the energy sector often comes to mind, which mirrors the swings of global fuel prices, policy shifts, and investor sentiment toward renewable transition plays.In this market, First Gen Corporation (PSE: ...

While most investors focus on short-term market movements and large-cap plays, companies like AXLM continue to deliver quietly in the background. Find out why our financial adviser thinks the food company focused on delivering coconut products is one of the market’s most undervalued companies.

When Axelum Resources Corp. (PSE: AXLM) debuted on the Philippine Stock Exchange in October 2019, it entered the market with strong investor interest. At the time of its initial public offering (IPO), AXLM positioned itself as a key player in the coconut ...

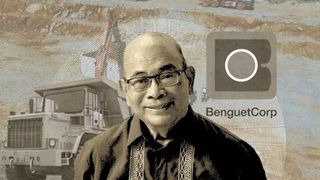

Benguet Corp., has staged one of the most dramatic earnings comebacks in the Philippine market in recent years.

The Philippine Stock Exchange Index (PSEi) has had a turbulent ride this year. Global economic uncertainty, exchange rate pressures, and volatility in commodity prices have weighed heavily on investor sentiment.Blue-chip names in banking and property have delivered mixed results, and ...

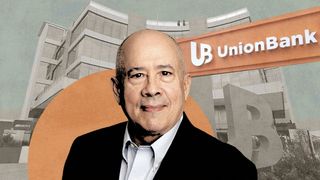

UnionBank of the Philippines (PSE: UBP) has seen better days on the trading floor, but there are signs that the worst may be behind it. After three years of relentless decline, UBP’s share price appears to be stabilizing.

UnionBank of the Philippines (PSE: UBP) has seen better days on the trading floor. Once a market favorite, the stock soared to more than P110 in 2022 at the height of optimism surrounding its digital banking push and the landmark acquisition of ...

Backed by Udenna Corporation and state-owned China Telecom, Dito Telecommunity built a nationwide 4G/5G network, captured millions of subscribers quickly, and offered faster, cheaper, and more reliable mobile internet.

When DITO Telecommunity (PSE: DITO) entered the market in 2021, it carried the promise of breaking the long-standing duopoly and bringing real competition to an industry long dominated by PLDT and Globe.Backed by Udenna Corporation and state-owned China Telecom, ...

Not all REITs are created equal. While some REITs have rewarded patient investors with consistent dividends and even capital appreciation, others are still trading below their IPO price.

When the first REITs were launched in the local market, they were heralded as a way for investors to gain steady income streams from premium office towers, malls, and commercial properties without needing to directly own physical real estate.Since then, the ...

The Philippine Stock Exchange has slipped 3.26 percent year-on-year so far this 2025, leading investors to look for defensive stocks that combine stability with cash-flow visibility. Energy stocks have answered that demand.

The Philippine Stock Exchange Index (PSEi) has yet to find clear direction this year. So far, it has slipped by 3.26 percent year-to-date and extended the weakness that started last year.After a volatile market last year, driven by ...

While the market remains bearish, opportunities still exist for those who are willing to look beyond the current pessimism and invest strategically.

As we pass the mid-year mark, the stock market faces significant challenges. Persistent market uncertainties, driven by the looming threat of a global recession and ongoing conflicts in the Middle East, have dampened investor sentiment. These factors have contributed to the ...

Amid the recent bearish performance of the stock market, a few standout performers have bucked the trend. These outperformers often lead the early stages of a recovery, and identifying where investor conviction is strongest can offer valuable clues for future gains.

As we pass the midpoint of 2025, the Philippine stock market continues to face headwinds. Global uncertainties, ranging from heightened recession fears and escalating Middle East conflicts to the recent wave of US tariffs on key imports, have all contributed to dampening ...

Hotel101 Global, the international hospitality arm of DoubleDragon Corporation, is making history as the first Filipino-owned company to list on the US Nasdaq market. What does this mean for Filipino investors and global observers and how can you benefit from this first-of-its-kind listing?

In a landmark moment for Philippine business, Hotel101 Global, the international hospitality arm of DoubleDragon Corporation, is making history as the first Filipino-owned company to list on NASDAQ. On June 27, Hotel101 will begin trading under the ticker HBNB, following its ...

Load More Articles